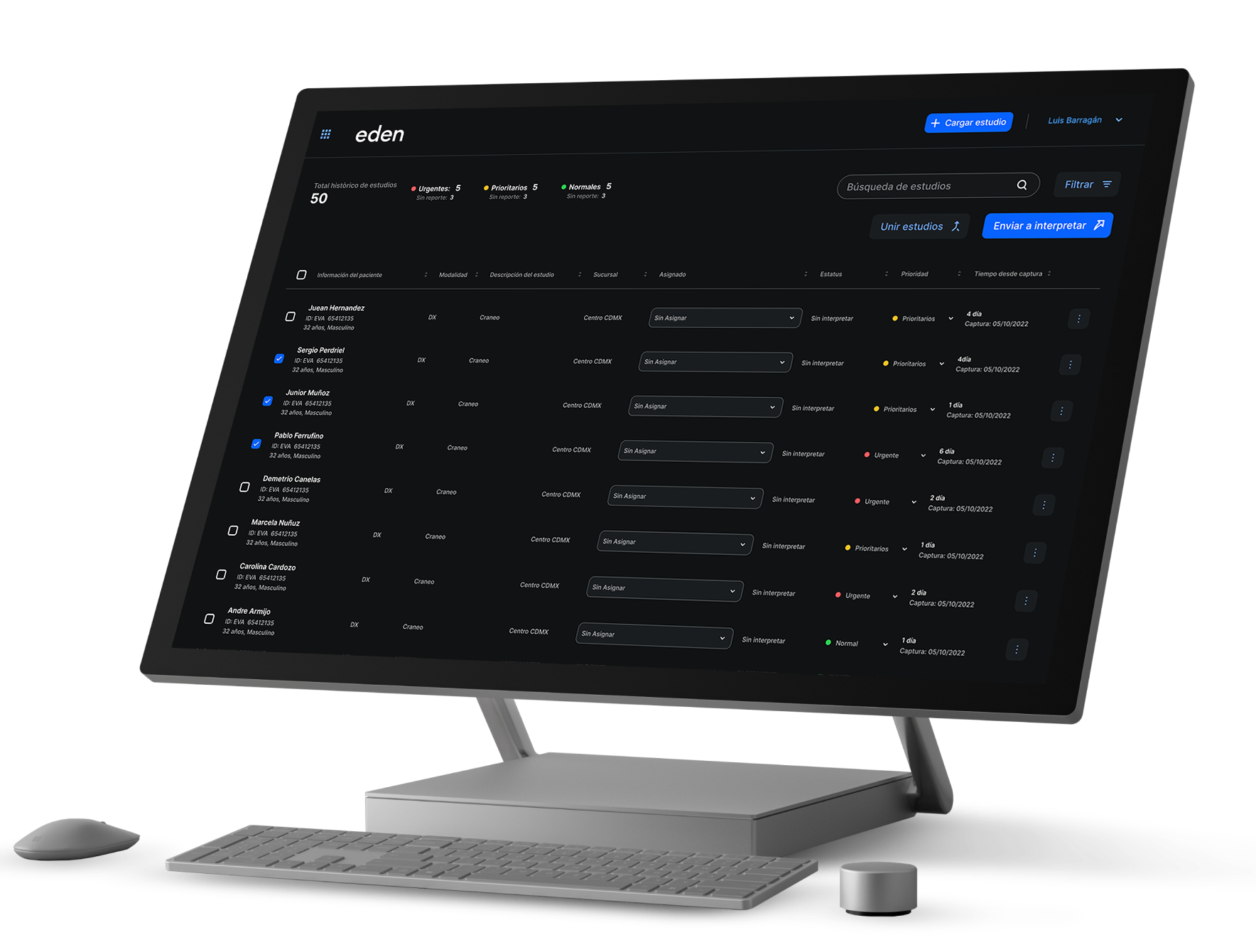

A clinical budget is a monetary allocation that is set aside to fund clinical activities. It helps clinicians plan and control expenses so they don't run out of money before the end of the fiscal year. If you operate as an individual entrepreneur or corporation, you can also use a clinical budget to record accounting transactions related to your business. A clinical budget can be used by doctors in private practice or other medical organizations to manage their financial resources. It will help you to anticipate costs and expenses over the next year, so you can allocate your resources wisely and keep track of how much money you have left at any given time. With a clear understanding of your financial situation, you'll be able to make informed decisions about how to best use your resources for the rest of the fiscal year and beyond. One option to optimize your revenues and reduce costs is Eva Pacs, because with our technology we accelerate diagnostic processes and reduce costs.

Why is it important to maintain a clinical budget?

A clinical budget is a fundamental component of any business management system. It will help you keep track of your expenses, especially when you have limited resources and a lot of expenses to cover. A budget will help you prioritize spending, plan for potential deficits, and avoid incurring debt, if possible. Having a clear budget will also help you track your progress, providing valuable information that can help you improve your business practices and make better financial decisions in the future. A budget can help you make informed decisions about how to use and stay within your resources throughout the year. For example, if you need to hire employees to help you manage your query, but you're not sure if you have the necessary budget to do so.

A clinical budget will help you make informed decisions about how to best use your resources, such as hiring contractors or outsourcing certain tasks and keeping your costs under control.

Create a budget plan Doctor

To create a budget plan, you'll need to start with your budgeted annual income and expenses. Once you've created a schedule of budgeted income and expenses, you'll need to consider additional factors such as your monthly cash flow, the cost of capital, and other expenses that may not occur annually. You can then create a budgeted balance sheet to keep track of your assets, liabilities, and net worth. A budget plan is an essential first step in creating a budget. It lets you know how much money you're coming in and how much you need to spend. While it's important to keep in mind that budgets aren't immovable, creating a budget plan is a critical first step in creating a clinical budget that works.

Record accounting transactions

Clinical budgets are used for more than just planning and keeping track of expenses. You can also use a clinical budget for general records and record accounting transactions, so you can keep track of your income and expenses. You can do this in an accounting program such as Quickbooks Online or an accounting program such as Xero. A clinical budget can be a useful tool when you're trying to account for expenses related to your business. You can use a clinical budget to record any expenses related to your practice, including payments to contractors, office supplies, and even employee expenses. You can also use a clinical budget to record any income generated by your business, such as payments received from insurance companies, Medicare and other third-party payers.

Identify the main cost factors

A clinical budget can help you identify the main cost drivers and determine how to manage them. Cost generators are expenses that change depending on the number of services or procedures being provided. For example, the cost of operating rooms is usually calculated on a per-procedure basis. You can use a clinical budget to track the number of procedures you perform and predict associated costs. A clinical budget can help you identify cost factors in any department of your practice. You can then use this information to adjust your budget and make adjustments to accommodate associated costs. This will help you avoid overspending in certain areas, while providing the necessary financial resources to cover other expenses.

Summary of clinical budgeting

A clinical budget can help you plan for the future and make smart financial decisions. It can help you anticipate changes in income and expenses so you can adjust your budget accordingly. It can also help you track your financial progress and improve your budgeting skills over time. A clinical budget can be beneficial for any company, but especially for doctor's offices. A budget can help you control and manage expenses, anticipate future costs and make better financial decisions.